每个月的最后一天都会做个目录,方便自己也方便大家~

2019年10月:

AJINOMOTO最新季度财政报告

AEONCR最新季度财政报告

我的2019年第3季度投资成绩

2019年9月:

何谓财务教育(3):学习金钱的语言

2019年8月:

PANAMY最新年度财政报告

HARTALEGA最新年报和季度业绩

2019年7月:

何谓财务教育(2) : 精明地选择导师

何谓财务教育(1) : 态度

TOPGLOV 最新季度业绩

AEONCR股东大会2019+最新季度业绩

2019年6月:

我的2019年上半年投资成绩

不喜欢学习关于投资的人

PANAMY最新季度业绩

AEON股东大会+最新季度财政报告

2019年5月:

从股票投资中获得影子收入

我的2016年投资成绩

HARTALEGA最新季度财政报告

AEONCR最新季度财政报告

我的2015年投资成绩

2019年4月:

HUPSENG最新年度财政报告

我的投资理论之一--大便论

TOPGLOV最新季度财政报告

2019年3月:

我的2019年第1季度投资回酬

AEON最新季度财政报告

HARTALEGA最新季度财政报告

2019年1月:

AEONCR最新季度财报

一个记录我在马来西亚股市投资经历的地方。 A place where I write down all my investment experiences in Malaysia Stock market.

Thursday, 31 October 2019

List of articles of January~October 2019

I will make a list of articles every last day of the month,

so that is easier for me and for everyone to refer~

October 2019:

AJINOMOTO latest quarter financial report

AEONCR latest quarter financal report

My investment result for 3rd Quarter 2019

September 2019:

What is Financial Education(3): LEARN THE LANGUAGE OF MONEY

August 2019:

PANAMY latest annual financial report

HARTALEGA latest annual report & quarter report

July 2019:

what is Financial Education(2) : CHOOSE YOUR TEACHERS WISELY

What is Financial Education (1) : ATTITUDE

TOPGLOV latest financial result

AEONCR AGM 2019+latest quarter financial result

June 2019:

My investment result for 1st half of year 2019

Those who don't like to learn about investment

PANAMY latest financial result

AEON AGM + latest quarter financial result

May 2019:

The PHANTOM INCOME from shares investment

My investment return for year 2016

HARTALEGA latest financial report

AEONCR latest quarter financial report

My investment return for year 2015

April 2019:

HUPSENG latest annual report

One of my investing theorem--"The SHIT Theorem"

TOPGLOV latest quarter financial report

March 2019:

My investment return for 1st quarter 2019

AEON latest quarter financial report

HARTALEGA latest quarter financial report

January 2019:

so that is easier for me and for everyone to refer~

October 2019:

AJINOMOTO latest quarter financial report

AEONCR latest quarter financal report

My investment result for 3rd Quarter 2019

September 2019:

What is Financial Education(3): LEARN THE LANGUAGE OF MONEY

August 2019:

PANAMY latest annual financial report

HARTALEGA latest annual report & quarter report

July 2019:

what is Financial Education(2) : CHOOSE YOUR TEACHERS WISELY

What is Financial Education (1) : ATTITUDE

TOPGLOV latest financial result

AEONCR AGM 2019+latest quarter financial result

June 2019:

My investment result for 1st half of year 2019

Those who don't like to learn about investment

PANAMY latest financial result

AEON AGM + latest quarter financial result

May 2019:

The PHANTOM INCOME from shares investment

My investment return for year 2016

HARTALEGA latest financial report

AEONCR latest quarter financial report

My investment return for year 2015

April 2019:

HUPSENG latest annual report

One of my investing theorem--"The SHIT Theorem"

TOPGLOV latest quarter financial report

March 2019:

My investment return for 1st quarter 2019

AEON latest quarter financial report

HARTALEGA latest quarter financial report

January 2019:

Monday, 21 October 2019

AJINOMOTO最新季度财政报告

话说今年我的投资回酬真的没眼看,

一直负回酬,

主要原因还是今年我投资组合里的公司业绩都不给力,

也令我相隔5年再次尝收到投资没钱赚的压力。

有鉴于此,

我决定再次打开眼睛看看其他的上市公司,

看看还有没有什么值得投资的公司。

所以,

今天就来看看AJINOMOTO的最新季度财政报告:

不错,

营业额进步,

盈利也跟着进步。

唉........

要是我如今投资组合里有任何一家公司像AJINOMOTO一样就好了...............

然后看看区域销量:

本地市场的销量滑落,

但幸好中东和其他亚洲区域的销量有所补救。

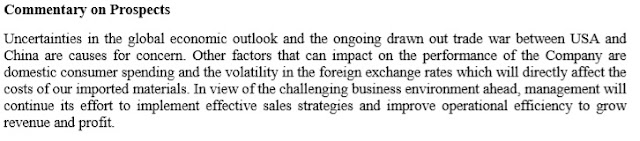

看看公司的发言:

有提到说这次营业额成长主要是Industrial Business部分,

销量增加以及美元兑马币的上涨。

上面也有提到说盈利增加的因素除了营业额增长以外,

其中一个主要原料的价格下跌也是原因之一。

所谓的主要原料应该就是小麦吧,

我上网看了看国际小麦价格,

的确是比以前低。

最后是对未来的展望:

外围方面,

公司担心世界经济局势和美中贸易战。

除此以外,

本地消费则支出和外币波动也会影响公司的业绩。

以上就是本次关于AJINOMOTO最新季度财政报告的要点,

若你觉得有所不足的话,

欢迎到BURSA网站自己下载一份来细读。

在这里也顺便放上AJINOMOTO的产品,

首先是零售产品:

都是本地较常见的产品,

上文有提到说今年推出了名为RASA SIFU的新产品。

然后是工业产品:

上文也提到说推出了新的TENCHO产品以提供给Dairy industry。

除此以外,

AJINOMOTO也在Negeri Sembilan买了一块地,

以建设新厂。

前几年AJINOMOTO因为一个特别股息,

而股价攀升到20多块,

现在滑落到16块以下,

是否值得投资呢?

投资就是自己思考,自己做决定。

感谢阅读。

以上言论没有任何买卖建议,

大家买卖自负。

大家买卖自负。

AEONCR最新季度财政报告

我的2019年第3季度投资成绩

何谓财务教育(3):学习金钱的语言

PANAMY最新年度财政报告

HARTALEGA最新年报和季度业绩

其他链接:

我的投资成绩

关于本人

我的脸书专页

2019年文章目录

2017年文章目录

AJINOMOTO Latest Quarter Financial Report

The investment return of my portfolio for this year is very bad,

a negative return.

Mainly because all the companies I investing didn't achieve good financial result this year,

thus I started to feel the pressure again of not earning any money through investment after almost 5 years.

As a result,

I decided to open my eyes and look around,

to see is there any other company which is worthy to invest.

The first company I looked at,

is AJINOMOTO and the latest financial result:

Not bad,

the revenue and profit both showed improvement.

Aiks.........

If only any of the companies I investing showed these same improvement as AJINOMOTO.............

Next,

let's look at the regional sales:

The revenue for Malaysia dropped,

but Middle East and other Asian countries covered it up.

Next,

the comments by management:

The management mentioned that the higher revenue was mostly contributed by Industrial Business segment,

which benefited from higher sales volume and strong US Dollar against Ringgit Malaysia.

Another reason of higher profit is the reduced cost of a key raw material.

Lastly,

The management is worried about the uncertainties in global economic and the trade war between USA and China.

Apart from that,

domestic consumer spending and volatility in foreign exchange rates will affect the performance of company.

That's all for the important points of this quarter report,

if you feel like something is lacking,

feel free to go to BURSA website to download and read it.

Also,

I will put up some information of AJINOMOTO products here,

first are the retail products:

Those are the products which we usually seen at local market,

a new product called RASA SIFU was launched this year.

Next,

the industrial products:

The company launched new TENCHO product for dairy industry.

As for this year,

AJINOMOTO also purchased a land at Negeri Sembilan to build new plant.

I still remember that last time the shares price of AJINOMOTO rose to more than RM20 because of a special dividend,

now the shares price is below RM16,

is it worthy to invest?

Investment is about doing own thinking, making own decision.

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

AEONCR latest quarter financal report

My investment result for 3rd quarter 2019

What is Financial Education(3): LEARN THE LANGUAGE OF MONEY

PANAMY latest annual financial report

HARTALEGA latest annual report+quarter report

Other links:

Friday, 11 October 2019

AEONCR最新季度财政报告

话说AEONCR释出最新的季度财政报告时,

我因为烟霾问题而流亡国外,

只是读了读报告,

并没有好好地写下部落格。

一直到今天终于有时间,

才决定好好地写下来。

记得当时是朋友在Whatsapp分享了业绩报告,

所以我一开始就知道这次的盈利跌得很难看,

当然也马上跑去BURSA网站下载来看。

首先,

营业额是有进步的:

但继续往下看,

我就开始听到心碎的声音在我体内响起:

再继续往下看,

我的心更是碎得一塌糊涂:

唉......

当时还在想是不是在做恶梦..........

不过如果跑去看Cashflow Statement:

最后一行的Operating profit还是显示着有进步。

当然,

因为多拨出的Impairment loss毕竟不是真的100%损失,

当然要填补回cashflow里。

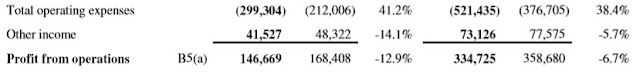

接下来看看管理层的发言:

其实生意量还是有所增长,

NPL ratio也从去年的2.07%降到2%。

不过支出对比营业额却从去年的63.8%上涨至74%,

因为更高的Impairment loss和promotional expenses:

Funding cost也是比去年高。

下面就有提到说因为MFRS 9会计准则,

所以Impairment loss高了很多:

最后是对于未来的展望:

只提到营业额成长了19%,

盈利方面只字不提。

股息方面:

还好还是保持了每股22.25sen。

以上就是本次关于AEONCR最新季度财政报告的要点,

若你觉得有所不足的话,

欢迎到BURSA网站自己下载一份来细读。

总的来说,

首先我个人并没预料到MFRS 9会计准则会对盈利的表现方式影响那么大,

以前所认为的AEONCR高成长和低PE的两大优势,

其中低PE已经荡然无存。

为此,

我会重新审视AEONCR在我投资组合里的地位。

投资就是自己思考,自己做决定。

感谢阅读。

以上言论没有任何买卖建议,

大家买卖自负。

大家买卖自负。

我的2019年第3季度投资成绩

何谓财务教育(3):学习金钱的语言

PANAMY最新年度财政报告

HARTALEGA最新年报和季度业绩

何谓财务教育(2): 精明地选择导师

其他链接:

我的投资成绩

关于本人

我的脸书专页

2019年文章目录

2017年文章目录

AEONCR Latest Quarter Financal Report

When AEONCR released the latest quarter financial report,

I was not at Malaysia to save myself from the haze,

so I only read the report without writing anything down on my blog.

Until now,

I finally have time to write it down.

I remember that I already knew that the result was very bad since my friend shared it with me,

then I quickly went to download the report from BURSA website.

First of all,

the revenue improved:

But when I continued to read,

I started to hear the sound of my heart breaking:

The more I read,

the more broken my heart was:

How I wished it was a nightmare only.............

HOWEVER,

when I went to look at the Cashflow Statement:

The Operating profit still showed a good improvement.

Well yeah,

since the extra impairment loss is not real 100% loss,

of course need to put it back into cashflow.

Next,

Let's read the comment by management:

The revenue improved by 21.8%,

and the NPL ratio dropped from 2.07% to 2% only.

However,

because of higher impairment loss and promotional expenses,

the ratio of total operating expense against revenue rose from 63.8% to 74%:

The funding cost also higher than last year.

Below also mentioned that higher impairment loss was because of the MFRS 9 accounting standard:

Lastly,

the current year prospects:

Only mentioned that the revenue grew by 19%,

no mentioning of profit...............

As for dividend:

Thankfully still maintained as 22.25 sen per share.

That's all for the important points of this quarter report,

if you feel like something is lacking,

feel free to go to BURSA website to download and read it.

Frankly speaking,

I didn't expect that the new MFRS 9 accounting standard will affect the profit so much.

As a result,

the two advantages of investing at AEONCR: High growth and low PE.

PE is not low anymore.

Thus,

I will re-consider how much should I invest at AEONCR.

Investment is about doing own thinking, making own decision.

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

My investment result for 3rd quarter 2019

What is Financial Education(3): LEARN THE LANGUAGE OF MONEY

PANAMY latest annual financial report

HARTALEGA latest annual report+quarter report

What is Financial Education(2): CHOOSE YOUR TEACHERS WISELY

Other links:

Wednesday, 2 October 2019

我的2019年第3季度投资成绩

一晃眼,

3个月又过去了。

9月中时因为烟霾侵袭我国,

所以临时决定流亡在外国,

一直到9月尾才回来。

因为这样,

所以本次的投资成绩比往常迟了几天才出炉~

今年9个月的回酬为ROA = -2.14%,ROE = -3.13%,

3个月前的正回酬宣告破灭,

再次回到来负回酬...........

接下来对比看看2019年头和9个月后的投资组合:

2019年一开始时,

我的投资组合如下:

1) AEONCR (31%)

2) HARTA (21%)

3) LPI (17%)

4) PANAMY (12%)

5) PBBANK (8%)

6) AEON (7%)

7) NESTLE (4%)

9个月后,

变成了这个样子:

1) HARTA (35%)

2) AEONCR (34%)

3) LPI (16%)

4) AEON (9%)

5) NESTLE (5%)

6) PANAMY (1%)

本次的负回酬,

主要是因为AEONCR从RM16.80跌到RM14.90所致。

(根据10月1日的股价。)

实话实说,

我低估了MFRS 9会计准则对AEONCR盈利的影响。

在这里顺便写下历年的投资成绩:

2011 : ROE = +28.0%

2012 : ROE = +32.8%

2013 : ROE = +15.0%, ROA = +13.3% (开始使用SMF)

2014 : ROE = -12.0%, ROA = - 8.0%

2015 : ROE = +21.6%, ROA = +13.3%

2016 : ROE = +38.0%, ROA = +22.2%

2017 : ROE = +40.5%, ROA = +24.9%

2018 : ROE = +16.0%, ROA = +13.3%

只剩下不到3个月的2019年,

我有没有希望扭转如今的负回酬呢?

感谢阅读。

以上言论没有任何买卖建议,

大家买卖自负。

大家买卖自负。

何谓财务教育(3):学习金钱的语言

PANAMY最新年度财政报告

HARTALEGA最新年报和季度业绩

何谓财务教育(2): 精明地选择导师

何谓财务教育(1):态度

其他链接:

我的投资成绩

关于本人

我的脸书专页

2019年文章目录

2017年文章目录

My investment result for 3rd Quarter 2019

In the blink of eyes,

another 3 months already passed by.

The haze attacked my country at middle of September,

so I decided to stay away from it by being at another country,

until end of September only came back.

Thus,

my investment result article for this time is later than usual.

This year my 9 months return is ROA = -2.14%, ROE = -3.13%,

again I am back to negative return.

Let's have a comparison between my investment portfolio at the start of year 2019 and now:

When year 2019 first started,

this was my investment portfolio:

1) AEONCR (31%)

2) HARTA (21%)

3) LPI (17%)

4) PANAMY (12%)

5) PBBANK (8%)

6) AEON (7%)

7) NESTLE (4%)

After 9 months,

it became like this:

1) HARTA (35%)

2) AEONCR (34%)

3) LPI (16%)

4) AEON (9%)

5) NESTLE (5%)

6) PANAMY (1%)

This time,

my negative return was mainly contributed by AEONCR which dropped from RM16.80 to RM14.90.

(According to the shares price at 1st October.)

Frankly speaking,

I failed to estimate that the new MFRS 9 accounting standard will affect the profitability so much.

Also,

hereby listing down my investment return for the past few years:

2011 : ROE = +28.0%

2012 : ROE = +32.8%

2013 : ROE = +15.0%, ROA = +13.3% (started using SMF)

2014 : ROE = -12.0%, ROA = - 8.0%

2015 : ROE = +21.6%, ROA = +13.3%

2016 : ROE = +38.0%, ROA = +22.2%

2017 : ROE = +40.5%, ROA = +24.9%

2018 : ROE = +16.0%, ROA = +13.3%

Only less than 3 months left for this year,

will I be able to turn my negative return back to positive return?

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

What is Financial Education(3): LEARN THE LANGUAGE OF MONEY

PANAMY latest annual financial report

HARTALEGA latest annual report+quarter report

What is Financial Education(2): CHOOSE YOUR TEACHERS WISELY

What is Financial Education(1): ATTITUDE

Other links:

Subscribe to:

Comments (Atom)