When AEONCR released the latest quarter financial report,

I was not at Malaysia to save myself from the haze,

so I only read the report without writing anything down on my blog.

Until now,

I finally have time to write it down.

I remember that I already knew that the result was very bad since my friend shared it with me,

then I quickly went to download the report from BURSA website.

First of all,

the revenue improved:

But when I continued to read,

I started to hear the sound of my heart breaking:

The more I read,

the more broken my heart was:

How I wished it was a nightmare only.............

HOWEVER,

when I went to look at the Cashflow Statement:

The Operating profit still showed a good improvement.

Well yeah,

since the extra impairment loss is not real 100% loss,

of course need to put it back into cashflow.

Next,

Let's read the comment by management:

The revenue improved by 21.8%,

and the NPL ratio dropped from 2.07% to 2% only.

However,

because of higher impairment loss and promotional expenses,

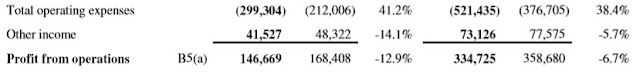

the ratio of total operating expense against revenue rose from 63.8% to 74%:

The funding cost also higher than last year.

Below also mentioned that higher impairment loss was because of the MFRS 9 accounting standard:

Lastly,

the current year prospects:

Only mentioned that the revenue grew by 19%,

no mentioning of profit...............

As for dividend:

Thankfully still maintained as 22.25 sen per share.

That's all for the important points of this quarter report,

if you feel like something is lacking,

feel free to go to BURSA website to download and read it.

Frankly speaking,

I didn't expect that the new MFRS 9 accounting standard will affect the profit so much.

As a result,

the two advantages of investing at AEONCR: High growth and low PE.

PE is not low anymore.

Thus,

I will re-consider how much should I invest at AEONCR.

Investment is about doing own thinking, making own decision.

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

My investment result for 3rd quarter 2019

What is Financial Education(3): LEARN THE LANGUAGE OF MONEY

PANAMY latest annual financial report

HARTALEGA latest annual report+quarter report

What is Financial Education(2): CHOOSE YOUR TEACHERS WISELY

Other links:

No comments:

Post a Comment