每个月的最后一天都会做个目录,方便自己也方便大家~

2020年3月:

我的2020年第1季度投资回酬

TOPGLOV最新季度财政报告

AEON最新季度财政报告

一个记录我在马来西亚股市投资经历的地方。 A place where I write down all my investment experiences in Malaysia Stock market.

Tuesday 31 March 2020

List of articles of January~March 2020

I will make a list of articles every last day of the month,

so that is easier for me and for everyone to refer~

March 2020:

My investment return for 1st quarter 2020

TOPGLOV latest quarter financial report

AEON latest quarter financial report

so that is easier for me and for everyone to refer~

March 2020:

My investment return for 1st quarter 2020

TOPGLOV latest quarter financial report

AEON latest quarter financial report

我的2020年第一季度投资成绩

2020年初,

新冠病毒席卷全球,

以致股市大跌。

而我也在这次大跌遭受了重创,

2020年第一季度的回酬为ROA = -16.1%, ROE = -27.6%。

可说是我接近10年的投资生涯中成绩最烂的一次。

接下来对比看看2020年头和现在的投资组合,

2020年一开始时,

我的投资组合如下:

1) HARTA (26%)

2) AEONCR (20%)

3) LPI (14%)

4) ALLIANZ (13%)

5) STMKB (11%)

6) AEON (8%)

7) NESTLE (6%)

8) PANAMY (2%)

现在:

1) HARTA(18%)

2) ALLIANZ (18%)

3) KOSSAN (17%)

4) AEONCR (14%)

5) AEON (10%)

6) STMKB (8%)

7) ELKDESA (6%)

8) 其他共9%

这次的负回酬,

几乎所投资的每家公司都贡献了不少,

AEON从RM1.42跌到RM1.13,

AEONCR从RM14.14跌到RM8.40,

ALLIANZ从RM16.28跌到RM12.48,

LPI从RM15.10跌到RM11.60,

STMKB从RM5.70跌到RM3.25。

唯一庆幸的是,

HARTA从RM5.48上涨到RM6.88,

不然我的投资回酬分分钟-30%以上。

这次大跌,

令我一度接近Margin Call的边缘,

加上当时万人传道集会的感染爆发,

所以我焦虑上涌,

一口气卖掉大量的股票,

几乎清掉SMF的负债。

最近这几天我才开始买回一些股票。

在这里顺便写下历年的投资成绩:

2011 : ROE = +28.0%

2012 : ROE = +32.8%

2013 : ROE = +15.0%, ROA = +13.3% (开始使用SMF)

2014 : ROE = -12.0%, ROA = - 8.0%

2015 : ROE = +21.6%, ROA = +13.3%

2016 : ROE = +38.0%, ROA = +22.2%

2017 : ROE = +40.5%, ROA = +24.9%

2018 : ROE = +16.0%, ROA = +13.3%

2019 : ROE = - 3.2% , ROA = - 2.2%

今年会不会创下我投资生涯里最烂的回酬呢?

这就得看人类VS新冠病毒的结果如何了。

投资就是自己思考,自己做决定。

感谢阅读。

以上言论没有任何买卖建议,

大家买卖自负。

TOPGLOV最新季度财政报告

AEON最新季度财政报告

我的2019年投资成绩

ALLIANZ最新年度和季度财政报告

ELKDESA最新年度和季度财政报告

其他链接:

我的投资成绩

关于本人

我的脸书专页

2019年文章目录

2017年文章目录

My investment return for 1st quarter year 2020

At 1st quarter of year 2020,

the corona virus spread through the whole world,

and caused a bear market.

As for me,

I am damaged by this bear market too.

My investment return for 1st quarter of year 2020: ROA = -16.1%, ROE = -27.6%,

which is the worst return of my investment life until now.

Below is the comparison of my investment portfolio at the start of year 2020 till now:

Start of year 2020:

1) HARTA (26%)

2) AEONCR (20%)

3) LPI (14%)

4) ALLIANZ (13%)

5) STMKB (11%)

6) AEON (8%)

7) NESTLE (6%)

8) PANAMY (2%)

Now:

1) HARTA(18%)

2) ALLIANZ (18%)

3) KOSSAN (17%)

4) AEONCR (14%)

5) AEON (10%)

6) STMKB (8%)

7) ELKDESA (6%)

8) Others (9%)

This time my negative return were contributed by most the companies in my portfolio,

including AEON which dropped from RM1.42 to RM1.13,

AEONCR from RM14.14 to RM8.40,

ALLIANZ from RM16.28 to RM12.48,

LPI from RM15.10 to RM11.60,

STMKB from RM5.70 to RM3.25.

Fortunately,

HARTA rose from RM5.48 to RM6.88,

if not my negative return will be more than 30%.

I was once very close to Margin Call during the sharp drop,

plus the rising cases in Malaysia due to Tabligh gathering,

my anxiety was at the maximum which caused me to sell a large portion of my shares,

and almost cleared my debt in SMF.

I started to buy back some of the shares since few days ago.

Anyway,

My investment return for the past few years:

2011 : ROE = +28.0%

2012 : ROE = +32.8%

2013 : ROE = +15.0%, ROA = +13.3% (started using SMF)

2014 : ROE = -12.0%, ROA = - 8.0%

2015 : ROE = +21.6%, ROA = +13.3%

2016 : ROE = +38.0%, ROA = +22.2%

2017 : ROE = +40.5%, ROA = +24.9%

2018 : ROE = +16.0%, ROA = +13.3%

2019 : ROE = -2.2% , ROA = -3.2%

Will I achieve the worst investment return for this year?

It all depends on the outcome of HUMAN VS COVID-19 war.

Investment is about doing own thinking, making own decision.

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

TOPGLOV latest quarter financial report

AEON latest quarter financial report

My investment return for year 2019

ALLIANZ latest annual report & quarter report

ELKDESA latest annual report & quarter report

Other links:

Saturday 21 March 2020

TOPGLOV最新季度财政报告

话说这个星期股市一直在下跌,

原本就想写篇文来抒发下感想,

偏偏局势每天都在变化,

想写的内容来到第二天就变得完全不适合,

刚好TOPGLOV出了个季度财政报告,

就来写写这个好了。

当然,

在文章的最后也会稍微提到我目前的投资情况。

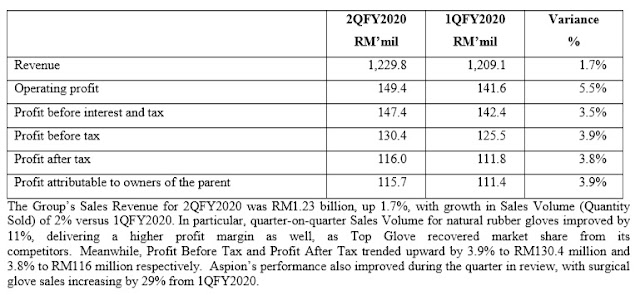

首先我们来看看TOPGLOV这个从2019年12月到2020年2月的业绩:

基本上各方面都有所进步,

但特别的是,

Profit after tax进步得特别明显。

这是因为税务方面的优惠,

下文有提到:

然后再看看与前一季的对比:

Sales Volume只增加了区区的1.7%,

记得当时是新冠肺炎还在中国猖狂的时候,

也就是说TOPGLOV来自中国市场的订单其实不多...........

看回2019年的Sales Volume地理分布图:

来自亚洲的订单加起来也只有22%而已。

下面也有提到说,

一开始的订单都来自于中国、香港、新加坡和韩国,

难怪Sales Volume才上升1.7%:

一直到最近,

还在隔岸观火的欧美国家发现大火已经烧到自己的家园,

才来增加订单。

这些订单量,

要等到下个季度的财政报告才能看出有多少了。

目前工厂的使用量在90%以上,

加上新的F2B和F5A,

产量暂时应该就只能增加那么多而已:

报告里还有提到说,

下一季的利息支出会明显减少:

算是个好消息吧!

然后管理层对公司未来展望乐观:

是啊,

我们也知道啊,

所以手套公司的股价最近都没什么跌。

以上就是本次最新季度财政报告的要点,

若你觉得有所不足的话,

欢迎到BURSA网站自己下载一份来细读。

依照现在的疫情来看,

手套股行业似乎春天来临,

但也别忘了,

目前各手套股公司的PE都挺高的,

在如今疫情严重冲击股市的情况下,

投资在手套公司真的会令你感到心安吗?

投资就是自己思考,自己做决定。

说回最近的大跌,

这次股市大跌起因还是因为新冠肺炎疫情,

眼看着疫情在马来西亚逐渐恶化,

甚至在世界各地也完全没有好转的迹象,

所以我卖了大部分的股票,

把SMF户口的负债额从高峰的6位数降低到4位数而已。

然后,

顺便说一下关于“社交距离。”

话说前几天我去复诊,

要走进去医院时,

就在入口处就看到一男一女挡在那里跟负责入口的医务人员对话。

要是平时的我,

就会走过去站在他们身后,

想办法进去。

不过最近新冠肺炎猖獗,

想说保持一下“社交距离”比较好,

就没过去,

而是站在一旁等待。

下一秒,

一个警卫就过来带那一男一女过去医院外面的临时营帐,

然后我才听到医务人员说那两人去过德国。

哇...................

幸好我保持了距离。

当然,

那两人未必是新冠肺炎患者,

但至少我保持了一段距离,

就不用太担心会被传染。

所以说,

请大家保持“社交距离”,

因为你永远也不知道,

那个离你很近看起来很健康的家伙,

可能就是个感染者!

感谢阅读。

以上言论没有任何买卖建议,

大家买卖自负。

AEON最新季度财政报告

我的2019年投资成绩

ALLIANZ最新年度和季度财政报告

ELKDESA最新年度和季度财政报告

TOPGLOV最新年度财政报告

其他链接:

我的投资成绩

关于本人

我的脸书专页

2019年文章目录

2017年文章目录

TOPGLOV Latest Quarter Financial Report

For the past few days which the shares market kept dropping,

I wanted to write article to express my feelings and opinion,

however,

the situation kept changing everyday,

the contents that I wanted to write became totally useless at the next day.

At this timing,

TOPGLOV released the latest quarter financial report,

so I will write about it then.

Anyway,

I will also write down a bit of my current shares investment at the end of this article.

From December 2019 until February 2020,

here is the financial result of TOPGLOV:

Basically having improvement in all aspects,

and the Profit after tax improved significantly.

This is because of the tax incentives and unutilised tax allowance which mentioned here:

Also,

let's look at the comparison with previous quarter:

The Sales Volume only grew by 1.7%....

This was during the period when Covid-19 condition is serious at China,

so seems like the glove sales to China wasn't that much.......

If look at the geographical segment of Sales Volume at year 2019:

Totally only 22% were from Asia...

According to what was mentioned below,

that time the sales order came from China, Hong Kong, Singapore and South Korea,

so no wonder only rose by 1.7%:

Only until recent weeks,

Europe, US and other countries which were eating popcorn and enjoyed watching how China fighting with the virus,

suddenly realized that the virus only came to their homeland,

then only they ordered more gloves.

We only able to know how much the increased Sales Volume will be from the next quarter report.

The current utilisation levels already above 90%,

with the new capacity from F2B and F5A,

that's all the new capacity the company can provide at this crucial period:

It was also mentioned that the interest costs will be reduced significantly :

Sounds like a good news!

The current year prospect:

The management is positive about the future of the company.

Yeah right,

we all know it too,

that's why the shares price of glove companies didn't drop recently.

That's all for the important points of latest financial report,

if you feel like something is lacking,

feel free to go to BURSA website to download and read it.

Due to the Covid-19 outbreak,

it seems like a good time for glove industry.

However the PE of the glove companies are quite high now,

at this moment when the shares market is very volatile and highly affected by the outbreak,

will you feel comfortable by investing at glove companies?

Investment is about doing own thinking, making own decision.

AS FOR MY INVESTMENT.............

Since recent sharp drop is because of the Covid-19 cases,

and seems like it is nowhere getting better in Malaysia,

even the whole world.

THUS,

I sold most of my shares,

the debt amount of my SMF account already dropped from 6 figures to 4 figures only,

yeah I am at very low debt level now.

By here I would like to talk about "SOCIAL DISTANCE" too.

Few days ago I went to hospital for my surgery wound,

when I was at the entrance,

I saw a man and a woman were blocking at the entrance while talking to a hospital staff there.

Usually,

I will just go behind them to line up and wait for my turn.

However since the rising COVID-19 cases,

I decided to have "SOCIAL DISTANCE",

so instead of standing near them,

I chose to stand aside far way and wait.

Next moment,

a security guard came and lead the man and the woman to a tent which built outside of hospital for a check-up,

then I heard the hospital staff said that they went to Germany before.

Wow............

Luckily I kept the SOCIAL DISTANCE.

Well of course,

they might not be infected with Covid-19,

but at least I kept a distance so I don't need to worry that much now.

SO....

Everyone please keep SOCIAL DISTANCE from others,

because you will never know that the people who is very near with you,

and looked very healthy,

might be a carrier of Covid-19!

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

AEON latest quarter financial report

My investment return for year 2019

ALLIANZ latest annual report & quarter report

ELKDESA latest annual report & quarter report

TOPGLOV latest annual report

Other links:

Monday 9 March 2020

AEON最新季度财政报告

好久没更新部落格了,

就先写个简单的季度财报文章来热身一下。

如标题所述,

这次要来看看AEON的最新季度财政报告:

看起来盈利好像进步了很多,对吧?

但别忘了,

2019年的业绩是采用最新的会计准则,

所以:

到最后其实第4季的盈利还少过去年的第4季.............

AEON的业务主要分为Retail Business和Property Management Services。

当中Retail Business的营业额比去年进步了4.5%:

Property Management Services的营业额则进步了2.8%。

管理层有提到说如果没有MFRS 16的冲击,

Retail Business的盈利其实增加很多:

另一方面,

要是没有MFRS 16,

Property Management Services的业务其实是退步的:

所以说MFRS 16在一方面带来好处,

却在另一方面带来坏处。

管理层对未来的展望:

主要还是担心经济会被新冠肺炎所影响。

最后是人见人爱的股息:

每股4 sen,

跟去年一样。

以上就是本次关于AEON最新年度和季度财政报告的要点,

若你觉得有所不足的话,

欢迎到BURSA网站自己下载一份来细读。

新冠肺炎的爆发,

导致人们拥去超市以囤积必需品,

短期来说对零售业是好的,

但长期来说,

却会严重影响国家经济,

并为零售业带来坏处。

现在只希望新冠肺炎能够尽早消失。

本人复归部落格的热身文章就写到这里,

以后可能会写一写关于本人经历手术的感想,

也可能不会写出来,

看心情再说吧!

感谢阅读。

以上言论没有任何买卖建议,

大家买卖自负。

我的2019年投资成绩

ALLIANZ最新年度和季度财政报告

ELKDESA最新年度和季度财政报告

TOPGLOV最新年度财政报告

2019篇:长期投资的后果

其他链接:

我的投资成绩

关于本人

我的脸书专页

2019年文章目录

2017年文章目录

AEON Latest Quarter Financial Report

It has been a long time since I updated the blog,

so I will start with warming up by writing a simple article about quarter financial report.

As what stated on the topic,

this time let's have a look at the latest quarter financial report of AEON:

Looks like the profit from operations improved a lot, right?

But please don't forget that the financial result of year 2019 is using the latest accounting standard,

thus:

At the end the profit for the 4th quarter was actually less than the same quarter at year 2018.........

AEON has two business segments which are Retail Business and Property Management Services.

The revenue for Retail Business improved by 4.5%:

The revenue for Property Management Services grew by 2.8%.

The management also mentioned that besides the MFRS 16 impact,

the profit for Retail Business actually improved a lot:

HOWEVER,

if without the impact of MFRS 16,

the result of Property Management Services is actually worse:

So MFRS 16 has its own pro and cons.

The current year prospects:

Mainly is the concern of Covid-19 outbreak which might impact the economy.

Lastly,

the lovely dividend:

4 sen per share,

same like previous year.

That's all for the important points of latest financial report,

if you feel like something is lacking,

feel free to go to BURSA website to download and read it

As for the outbreak of Covid-19,

people will be rushing to buy and accumulate necessary things,

which is good for the retail industry in short term.

However if the outbreak is long,

then it will definitely impact the economy and bad for the retail indudstry.

Now we can only hope that the Covid-19 will be gone as soon as possible.

That's all for my warming up article,

next time I might write about the surgery which I went through last month,

or maybe not,

depends on my mood~

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

My investment return for year 2019

ALLIANZ latest annual report & quarter report

ELKDESA latest annual report & quarter report

TOPGLOV latest annual report

2019 Version: The Consequence Of Long Term Investing

Other links:

Subscribe to:

Posts (Atom)