From June 2020 to September 2020,

the shares market was very drastic,

my investment return was sometimes high, sometimes low,

just like a never ending roller-coaster.

ANYWAY,my investment return until 3rd quarter 2020 is ROA = 29.1%, ROE = 50.1%.

Below is the comparison of my investment portfolio at the start of year 2020 till now:

Start of year 2020:1) HARTA (26%)2) AEONCR (20%)3) LPI (14%)4) ALLIANZ (13%)5) STMKB (11%)6) AEON (8%)7) NESTLE (6%)8) PANAMY (2%)

Now:1) AEONCR (22%)2) HARTA (20%)3) STMKB (12%)4) ALLIANZ (11%)5) ELKDESA (9%)6) KAWAN (8%)7) LPI (7%)8) TOPGLOV (6%)

9) KOSSAN (5%)

My positive return were mostly contributed by the appreciation of shares price which I bought during the bear market at March and April,

of course glove companies contributed the majority of the profit.

I lost around 1/3 of my net worth during the bear market at March,

so now I can say that I finally earn back what I lost.

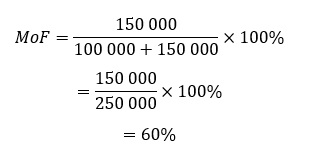

For example,if I have 100K at the start of year 2020,then I only left with 66K after the bear market.

From 66K back to 150K,I had to earn 84K by investing 66K only,which means that my return from the lowest point of shares market until now is around 127.3%.

Comparing my portfolio at the end of June and now,

my holding of AEONCR and HARTA shares increased,

while holding of KOSSAN shares decreased.

Well,

when shares price of glove companies rose too much last time,

I sold some of it,

especially I sold half of my KOSSAN shares and I used that money to buy more AEONCR shares.

Then share prices of glove companies dropped a lot,

so I also bought some HARTA shares.

After all these selling and buying,

I did earn a few extra thousand bucks,

but considering all the troublesome,

is it really worthy??

Anyway,

My investment return for the past few years:

2011 : ROE = +28.0%

2012 : ROE = +32.8%

2013 : ROE = +15.0%, ROA = +13.3% (started using SMF)

2014 : ROE = -12.0%, ROA = - 8.0%

2015 : ROE = +21.6%, ROA = +13.3%

2016 : ROE = +38.0%, ROA = +22.2%

2017 : ROE = +40.5%, ROA = +24.9%

2018 : ROE = +16.0%, ROA = +13.3%

2019 : ROE = -2.2% , ROA = -3.2%

As for my investment strategy for the future......................

For now,

the pandemic seems like nothing is changing,

so my investment is still no change as well.

Just that.......

everyone please think twice before going out to travel.

Everyone CUTI-CUTI MALAYSIA,

thus now COVID-COVID MALAYSIA~

Traveling is same like investing,

all are about doing own thinking,making own decision,and you take full responsibility of your decision.

Thanks for reading.

I don't provide any buying/selling suggestion above,please make your own investment decision and be responsible with it.

Recent articles :

Other links: