Since SMF(Share Margin Financing) account is something that not many people write about it,

so I decided to start writing it.

For those who have interest at SMF account,

feel free to read the two chapters below first:

When talking about SMF account,

the first question which appeared at everyone's mind is:

"Should I use shares or fixed deposit as collateral?"

The reason why this question arose,

is because of what is written on the promotion of SMF account:

Trading Limit : up to a maximum of 2.5 times against Fixed Deposit.

Trading Limit : up to a maximum of 1.5 times against Shares.

Trading Limit : up to a maximum of 1.5 times against Shares.

Wow~~~

2.5 times Trading Limit for Fixed Deposit,

but only 1.5 times Trading Limit for shares,

seems like using FD as collateral is much more worth it??

Is it???

I was thinking like that too,

only after my SMF Banker kindly explained to me,

I understood that the difference is not that significant.

WHY?

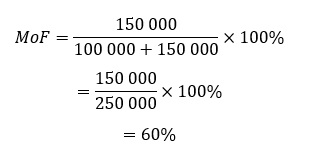

First let's see the calculation formula of MoF (Margin of Finance):

(I will write an article specially about MoF next time.)

Following the standard at Malaysia,

the MoF of majority of the SMF account is 60%,

so I will use 60% too.

Situation 1: 100K shares value as collateral

Beware!

It is 100K shares value!

Not 100K market shares value!

This is because the investment bank each set its won % of MV and Cap Price for different shares,

(I will write more about this at the future.)

so even though the shares is worthy of 100K market value,

but it might not be 100K shares value for the bank!

ANYWAY,

the main focus of this article is about the difference of using shares or FD as collateral,

and not about the MoF or Cap Price.

So to simplify everything,

we will assume that the MoF = 60%,

% of MV = 100,

and no Cap Price.

Again,

Situation 1: 100K shares value as collateral, no FD.

Since no FD,

so the calculation of MoF can be simplified like this:

When first started,

there is no outstanding loan,

and only 100K total shares value,

the MoF is 0%:

The 1.5 times Trading Limit,

is because of 1.5 X 100K = 150K,

which meant that maximum 150K loan can be used to buy more shares,

and the MoF will be exactly 60%:

At the end,

250K value of shares are acquired by having 150K loan.

Situation 2:

By using 100K FD as collateral,

this time we will use back the the complete formula:

By using FD as collateral,

2.5 times of Trading Limit will be given,

because 2.5 X 100K = 250K.

Thus,

250K loan can be used to buy more shares,

and the MoF will be exactly 60%:

At the end,

250K value of shares are acquired by having 250K loan.

As conclusion,

no matter it is situation 1 or 2,

at the very end still will have 250K value of shares.

That's why I mentioned above,

the difference is not very significant.

Of course,

Situation 1 : 150K loan, 250K shares

Situation 2 : 250K loan, 250K shares, 100K FD

If looking at it in terms of accounting,

it is sort of different.

However,

the risk of Force Selling is the same.

If the value of shares drop a lot until the MoF is over 70%,

then the Force Selling will be activated.

No matter Situation 1 or 2,

when the shares value dropped from 250K to 210K,

Force Selling will be activated:

"When using FD as collateral, the risk is still the same."

Basically,

only the calculation part a bit different,

the end result and the risk are the same.

Well,

unless it is OPM~

That's all I wanted to share about this topic,

feel free to comment below if there is any question.

Also,

feel free to ask anything about SMF,

then I will know what to share next~

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

Recent articles :

AEON & AEONCR AGM 2020

My investment return for 1st half year 2020

KAWAN AGM 2020

My buying & selling record from 9th to 28th April 2020

My buying & selling record from 24th March to 8th April 2020

My investment return for 1st half year 2020

KAWAN AGM 2020

My buying & selling record from 9th to 28th April 2020

My buying & selling record from 24th March to 8th April 2020

Other links:

No comments:

Post a Comment