闲着没事,

就来写写关于SMF(Share Margin Financing)户口好了。

强烈建议对SMF户口有兴趣的各位,

先看过以下两篇文章:

为何我使用SMF来投资

当年我迅速累积身家的3把武器

说到SMF户口,

很多人第一个的疑问就是.................

我应该用我的股票还是定期存款来抵押呢?

通常会产生这个疑问的原因,

就是SMF户口的宣传语都是这么写的:

Trading Limit : up to a maximum of 2.5 times against Fixed Deposit.

Trading Limit : up to a maximum of 1.5 times against Shares.

哇~~~~

抵押定期存款有2.5倍Trading Limit,

但是抵押股票才只有1.5倍Trading Limit,

看起来定期存款比较值得喔?

真的是这样吗?

当年我也是傻傻地这样认为,

但还好我的SMF Banker好心地解释了一番,

我才明白过来,

其实差别不大。

为什么呢?

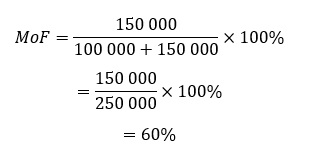

首先来看看MoF (Margin of Finance)的计算方法:

(关于MoF,以后我会写篇文章。)

然后根据我这里马来西亚,

大部分SMF户口的MoF都是60%,

所以我就用60%好了。

首先是状况一,

抵押总价值100K的股票。

注意!

不是总“市”值100K的股票噢!

而是总“价”值100K的股票!

这是因为银行有设置各股的% of MV和Cap Price,

(关于这些,以后也会写篇文章。)

所以就算有总市值100K的股票,

但对银行而言,

未必是总价值100K!

不过,

本文的重点在于抵押股票和定期存款的分别,

而不是关于MoF或Cap Price,

为了方便解释,

我们先假定MoF = 60%,

% of MV = 100,

然后银行没有设置Cap Price好了。

首先是状况一,

抵押总价值100K的股票,没有定期存款:

由于没有定期存款,

所以MoF的计算方法可以简化成:

还没有开始负债买股票时,

负债额是0,

总股票价值只有所抵押的100K,

所以MoF是0%:

所谓的1.5倍Trading Limit,

就是1.5 X 100K = 150K,

也就是说大概可以多负债150K来买股票,

如此一来MoF刚刚好是60%:

就结果而言,

在负债150K的情况下,

拥有大约250K价值的股票。

接下来是状况二,

抵押100K的定期存款,

抵押100K的定期存款,

这时就要用回最完整的算法:

抵押定期存款的话,

是2.5倍Trading Limit,

就是2.5 X 100K = 250K,

也就是说大概可以多负债250K来买股票,

如此一来MoF刚刚好是60%:

就结果而言,

在负债250K的情况下,

拥有大约250K价值的股票。

总归来说,

不管是状况一或状况二,

最终都是拥有250K价值的股票。

这就是我为什么一开始说,

结果是差不多的。

当然,

状况一:负债150K,股票250K

状况二:负债250K,股票250K,定期存款100K

如果不单纯看结果,

从会计账面上来看,

是有所不同的。

然后,

Force Selling的风险是一样的。

当股票大跌,

MoF超过70%时,

就会启动Force Selling。

不管状况一或者是状况二,

股票价值从250K跌到210K都会启动Force Selling:

“用定期存款抵押,风险没变,并不会更安全。”

基本上除了计算过程稍微不一样,

就结果和风险而言,

是一样的。

当然,

除非用OPM~

以上就是今次所要探讨的主题,

若有任何疑问,

欢迎留言。

对于SMF有什么想知道的,

或有任何不清楚的,

也可以留言给我,

这样我才会有灵感写文~

感谢阅读。

以上言论没有任何买卖建议,

大家买卖自负。

2017年文章目录

大家买卖自负。

AEON和AEONCR股东大会2020

我的2020年上半年投资成绩

KAWAN股东大会2020

我在2020年4月9日~28日之间的投资记录

我在2020年3月24日~4月8日之间的投资记录

其他链接:

我的投资成绩

关于本人

我的脸书专页

2020年文章目录

2019年文章目录

2018年文章目录我的2020年上半年投资成绩

KAWAN股东大会2020

我在2020年4月9日~28日之间的投资记录

我在2020年3月24日~4月8日之间的投资记录

其他链接:

我的投资成绩

关于本人

我的脸书专页

2020年文章目录

2019年文章目录

2017年文章目录