OFI is an interesting company to look at.

Why did I said so?

Let's have a look at the latest financial report:

The growth of revenue is excellent!

However the profit is not that satisfying..........

Sometimes the problem is.....

in order to sell more products, the more were spent for selling expenses,

eventually the problem of rising revenue but dropping profit will arise.

Anyway,

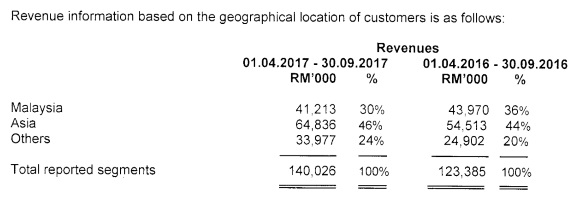

I started to put my eyes at OFI was because of the export market:

They did well at export.

The prospects from management:

The company is acquiring machines for expansion projects of new product lines,

which to be completed in stages for next few years.

Sounds very interesting.

How about have a look at the cash flow:

Negative cash flow of operating activities.

The cash used in investing activities is scary,

well no choice,

to acquire machines.

Even the company used a lot of cash,

but still maintaining the dividends.

The company having some loans and borrowings.

The company still had more than 40 million cash at the start of year 2016,

now only left with 4 million.

If company didn't borrow money, no cash left for them already.

The company spent so much cash, aggressively acquiring machines for new product lines,

will the future be bright?

Or dark?

Investment is about doing own thinking, making own decision.

Thanks for reading.

I don't provide any buying/selling suggestion above,

please make your own investment decision and be responsible with it.

please make your own investment decision and be responsible with it.

Recent articles :

Actually I don't like Bonus Issue & Share Split

F&N Aannual Report 2017

How I calculated my investment return(ROE&ROA)

Why did I use SMF for my investment

When my investment capital achieved 100K for the first time....

Other links:

List of articles of year 2017

My investment return for year 2017

My self-introduction article

My Twitter : @TheCellist86

No comments:

Post a Comment